Auto

RMA Data Plus's proprietary prospect database allows dealer groups and credit unions the opportunity to identify potential customers who are, based on their credit, in-market for a new or used car, ready for equity buyback, or near a lease termination.

Focused campaigns include:

Once prospects are identified, we launch the mail or email campaign to generate traffic to your dealership.

FTC guidelines on prescreening apply.

Mortgage

RMA Data Plus's proprietary prospect database allows mortgage providers the opportunity to identify their customers who are, based on their credit information, in-market for a new mortgage, refinanced mortgage, or equity loan.

Focused Campaigns:

The Home Improver:

Identify credit-qualified customers that have sufficient balance for an equity loan or refi cash out. Creating the first touchpoint for your customer.

Once the list is determined, you launch the qualified lead via a firm offer via mail or via phone. FTC guidelines on prescreening apply.

Consumer Finance

RMA Data Plus's proprietary prospect database allows consumer finance lenders the opportunity to have quick access to credit and demographic qualified lists

Final output files are NCOA and CASS certified.

Self-service database with “what-if” scenario capabilities.

FTC guidelines on prescreening apply.

Bank Card

RMA Data Plus's prospect database allows credit card issuers the opportunity to identify potential customers who are, based on their credit qualifications and credit card indicators, prospects for balance transfer or have a propensity to want another credit card.

Once prospects are identified, your print shop processes and mails the campaign.

Final output files are NCOA and CASS certified.

Self-service database with “what-if” scenario capabilities.

Once the list is determined, you launch the qualified lead via a Firm Offer via mail or via phone. FTC guidelines on prescreening apply.

Credit Unions

RMA Data Plus's proprietary prospect database allows our credit union customers the opportunity to have quick access to credit-qualified and demographic prospect lists.

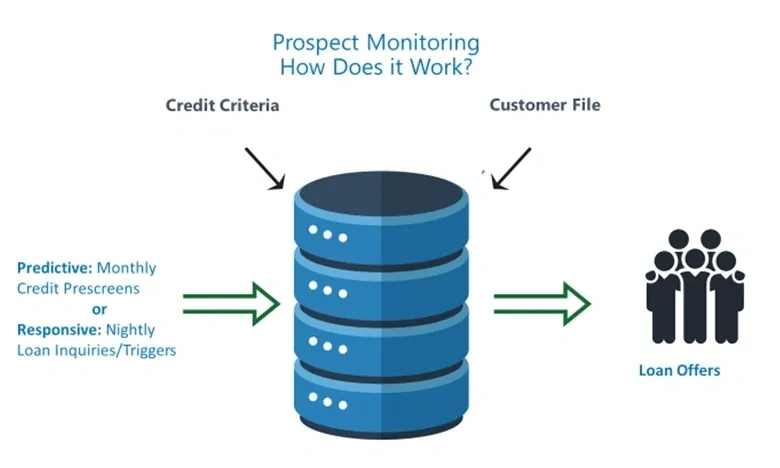

Prospect Monitoring

Student Loan

RMA Data Plus, Inc. has created a proprietary prospect database that allows consumer finance lenders the opportunity to have quick access to credit and demographic qualified lists.

Once the list is determined, you launch the qualified lead via a firm offer via mail or via phone. FTC guidelines on prescreening apply.

Final output files are NCOA and CASS certified.

Self-service database with “what-if” scenario capabilities.

Insurance

RMA Data Plus, Inc. has created a proprietary prospect database that allows insurance companies the opportunity to have quick access to credit-qualified and demographic prospect lists.

Prescreen Campaign Strategy (FCRA Compliant)

Once the list is determined, you launch the qualified lead via a firm offer via mail or via phone. FTC guidelines on prescreening apply.

Final output files are NCOA and CASS certified.

Self-service database with “what-if” scenario capabilities.